The concept of the Federal Reserve’s “forward guidance” is often seen as an unfalsifiable claim, a catch-all explanation that seems to justify any market reaction. It’s like saying the markets either completely ignore or strictly adhere to the Fed’s signals, a paradox in itself.

Consider the analogy of a rooster and the sunrise. The rooster’s crowing doesn’t cause the sun to rise; the sun follows its own schedule regardless of any perceived “forward guidance” from the rooster.

Similarly, a meteorologist doesn’t control the weather; they merely predict what’s likely to happen based on existing patterns. The weather isn’t influenced by their predictions. Imagine if there was a Federal Department of Weather where meteorologists were believed to control the climate. People would hang on every word of the weather forecast, wondering if the meteorologist would bring rain or sunshine. But in reality, the weather remains indifferent to these predictions.

The absurdity extends to a hypothetical situation where a federal meteorologist reports on weather that has already occurred and then claims to influence future weather conditions. If their predictions are wrong, it’s explained away as the weather ‘anticipating’ future forecasts.

This scenario parallels the role of the Federal Reserve, reminiscent of ancient rain dances where any subsequent weather change was attributed to the ritual. The belief in controlling complex, independent systems through rituals or predictions persists, even if it now comes in the form of economic policy discussions rather than tribal dances.

This situation can be likened to debates with creationists. In such discussions, any evidence that contradicts their beliefs is explained as a divine test of faith. Fossil records, distant starlight – all are seen as challenges to faith rather than scientific evidence. This unfalsifiable stance means that no amount of evidence can refute the belief; it’s always seen as part of a divine plan.

This approach mirrors the way some view the Federal Reserve. Regardless of whether the bond market responds to the Fed or not, it’s interpreted within the framework of faith in the Fed’s control. The mantra “Don’t fight the Fed” becomes more of a creed than an economic strategy, akin to a religious chant.

The discussion here isn’t about a fundamental law like in physics or a mathematical truth. Instead, it’s about the influence of a government entity, the Federal Reserve, on a highly complex and ever-changing system – the economy. Believing that the science behind this interaction is settled is a misconception.

Economics, though it involves advanced logical reasoning, falls short of being a true science. Its predictive power is limited, and its findings are often not replicable, a key failure point for many social sciences.

The widespread belief in the Federal Reserve’s power is the result of constant exposure to FOMC meetings, academic consensus, and media emphasis. Rarely do we see any serious consideration given to alternative perspectives; the dominant view is almost universally echoed by experts. This lack of scientific rigor in understanding complex systems like the economy leads one to question the near-unanimous agreement on the Fed’s role. A more inquisitive approach seems necessary.

Why is the view of the Fed, an institution that struggles to predict or control what it claims to, so uniformly accepted? Why do we often conclude incompetence rather than ineffectiveness? The answer seems clear.

Fed defenders often attribute to it a kind of omnipotence, claiming it sways markets not just with actions, but with mere words or even thoughts. This is particularly curious when we see the bond market frequently disregarding the Fed’s directives.

Consider the ongoing scenario: The Fed has been vocal about raising rates for around 1.5 years, yet the yield curve remains deeply inverted, suggesting that the bond market is essentially ignoring the Fed. This inversion indicates that long-term debt is yielding less than short-term, contradicting the typical economic logic.

The Fed may control short-term rates via the Federal Funds Rate, but it has no real influence over Treasury bonds, which are crucial in determining real-life borrowing costs. Despite this, some argue that bonds are actually in tune with the Fed’s future actions, even if they currently seem to contradict the Fed’s stance. This is akin to creationist arguments – attributing every contradiction to a grander, unknowable plan.

The reality is that the bond market responds to concrete economic indicators like GDP growth and inflation, not the Fed’s delayed reactions. The Fed, in this context, is more of a follower than a leader.

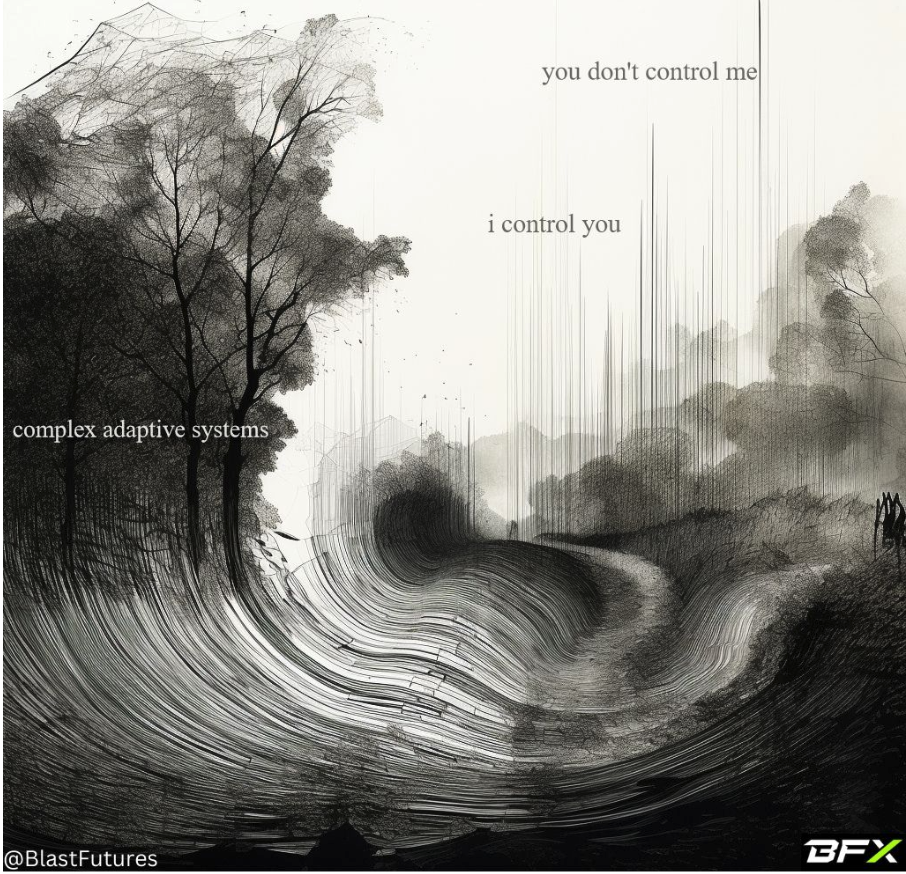

Considering the economy as a complex adaptive system, interest rates become the critical factor, dictating resource allocation and economic activity. Believing that a small group of individuals at the Fed can control such a vast system is a fallacy, similar to thinking one can manage the weather. It’s a kind of hubristic, communist-like belief in centralized control over a dynamic system.

Forward guidance from the Fed often resembles a tragic comedy. Despite their assertions and projections, the markets and economic realities often follow their own course. The Fed’s lack of predictive accuracy in this regard is striking, challenging the notion that they have any real control over economic rates and trends.

In the end, this series aims to highlight the importance of logic and psychology, alongside data and evidence, in understanding the role of the Fed. Economics is as much about logical reasoning as it is about empirical data. By examining both these aspects, we can gain a clearer understanding of the Fed’s actual influence and the importance of questioning widely accepted beliefs, especially when they pertain to complex systems like the economy.

Enjoyed the article?

Subscribe for more and follow us on Twitter at @Blastfutures